Who We Are

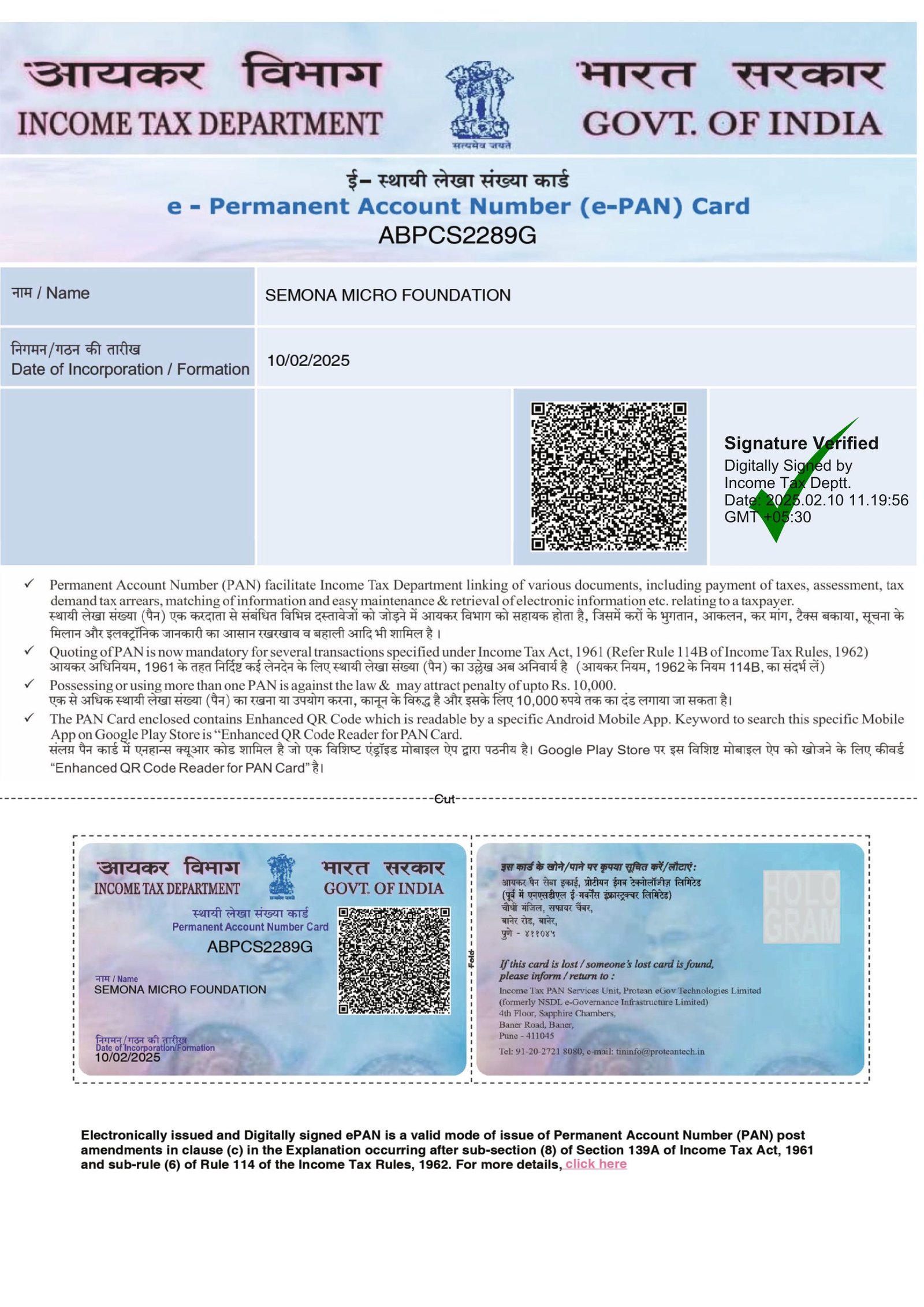

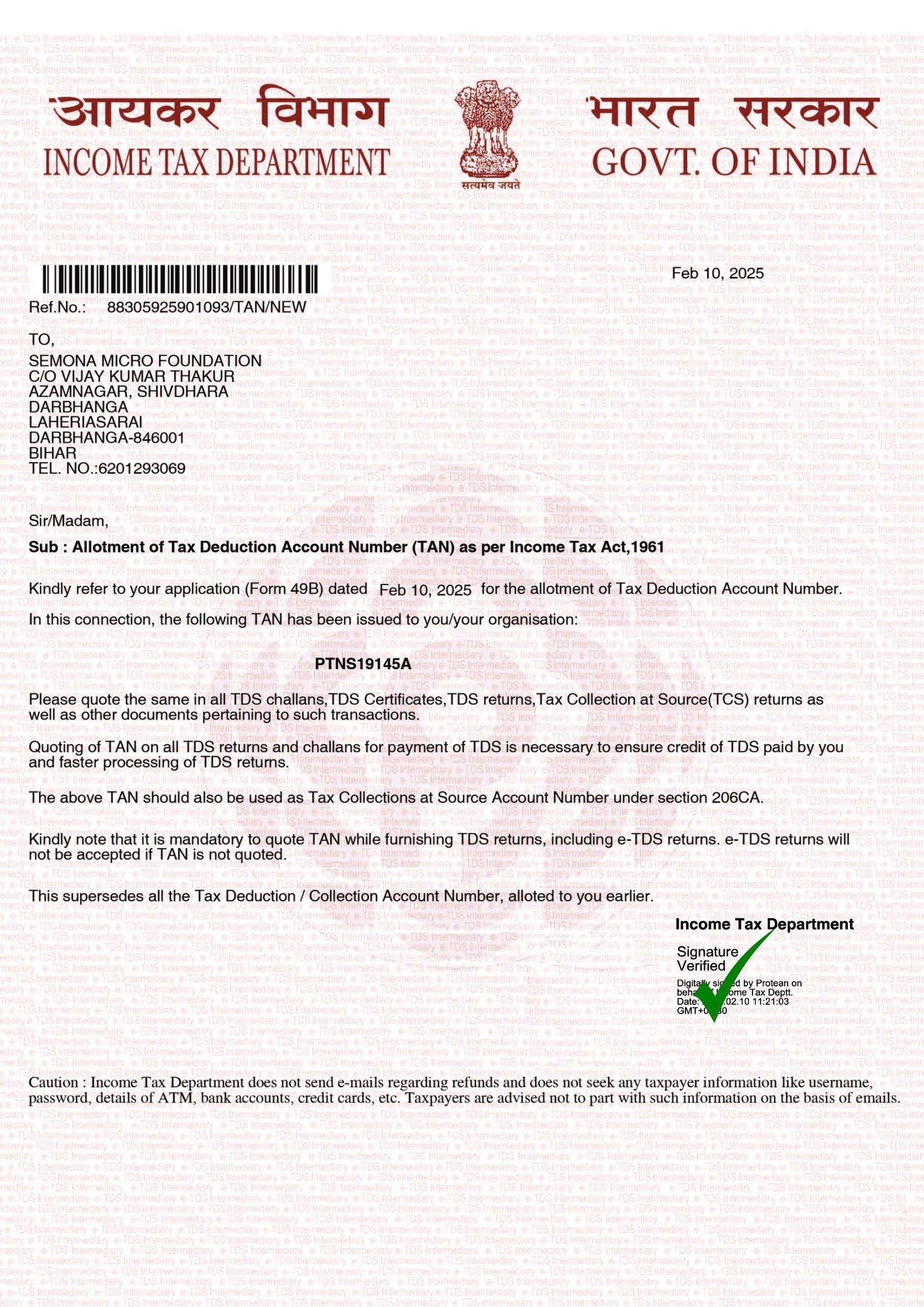

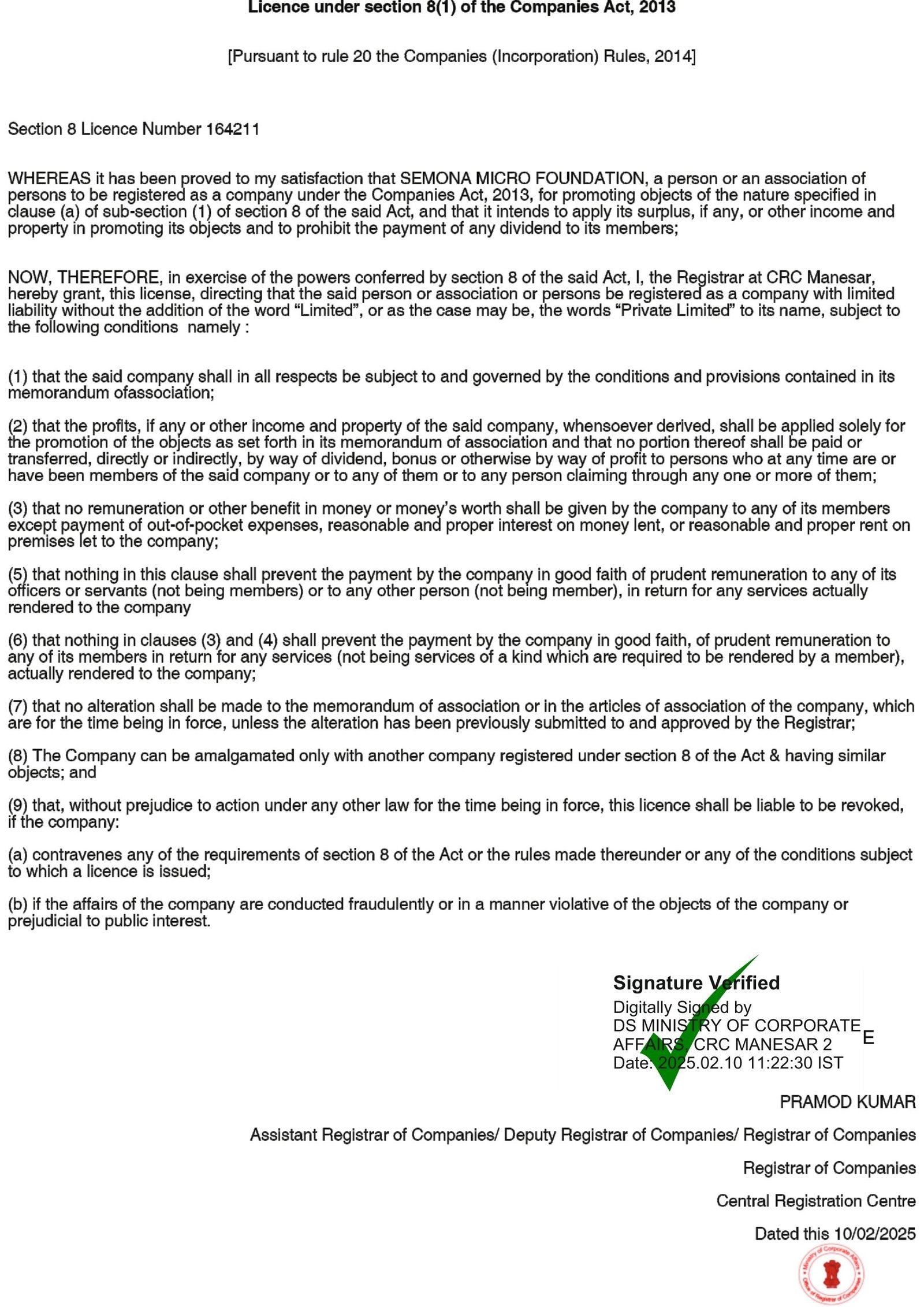

Semona Micro Finance is a leading microfinance institution dedicated to enhancing the socio-economic well-being of individuals and communities in rural and semi-urban areas. Established under Section-8 of the Companies Act, 2013, and registered as a Microfinance Institution Non-Banking Financial Company (MFI-NBFC) with the Finance Department of the Government of Bihar, our headquarters is located in Patna, Bihar.

At Semona Micro Finance, we believe in more than just providing financial services. Our mission is to empower underserved communities by addressing both their financial and non-financial needs. We strive to foster sustainable livelihoods, improve quality of life, and create opportunities for growth and development.

Our Core Values:

- Empowerment: We aim to uplift individuals and families, helping them achieve financial independence and self-reliance.

- Inclusivity: We are committed to providing accessible financial solutions tailored to the unique needs of our clients.

- Sustainability: We focus on fostering long-term growth and stability in the communities we serve.

- Integrity: We uphold transparency and ethical practices in all our dealings, ensuring trust and confidence among our stakeholders.

Through a range of products and services, including personal loans, business financing, and financial literacy programs, Amona Micro Finance is dedicated to making a positive impact in the lives of those we serve. Together, we can build a brighter future.

What We Do

At Semona Micro Finance, our initiatives are meticulously crafted to address the diverse needs of rural and semi-urban populations, with a steadfast focus on poverty alleviation and holistic development. Here’s a glimpse into our core activities:

Message from the Founders

As the founders of Semona Micro Finance, we are honored to embark on this journey of financial empowerment with you. Our mission is grounded in the belief that every individual, regardless of their circumstances, has the potential to thrive when given the right opportunities.

Through microcredit and financial inclusion, we aim to unlock opportunities for those often overlooked by traditional systems. By offering access to capital, fostering entrepreneurship, and providing financial literacy, we strive to uplift communities and enable sustainable livelihoods.

Together, we can foster a future where every person has the chance to achieve their dreams and build a brighter tomorrow.

financial inclusion, we aim to unlock opportunities for those often overlooked by traditional systems. By offering access to capital, fostering entrepreneurship, and providing financial literacy, we strive to uplift communities and enable sustainable livelihoods.

Together, we can foster a future where every person has the chance to achieve their dreams and build a brighter tomorrow.

With gratitude,

Nirasan Thakur-Managing Director

Priyanka Thakur-Director

MISSION

At Semona Micro Finance, our mission is to empower underserved communities by providing accessible financial solutions that promote entrepreneurship, economic self-reliance, and sustainable livelihoods. We aim to break the cycle of poverty by offering tailored microcredit services, financial literacy programs, and holistic support to individuals and small businesses, fostering long-term growth and social upliftment.

Vison

Our vision is to create a future where every individual, regardless of their socio-economic background, has the opportunity to thrive. We aspire to be a catalyst for sustainable development, driving inclusive economic growth, reducing poverty, and improving the quality of life for rural and semi-urban communities across India. These statements encapsulate a commitment to empowering individuals and fostering sustainable change. Let me know if you'd like to refine any part!

OUR AWARDS

PRODUCT DETAILS OF MICROFINANCE LOAN

PRODUCT NAME

SARAL

LOAN SIZE

10,000 to 50,000

RATE OF INTEREST

25% 26% Ρ.Α.

LOAN PROCESSING FEE

1.25% 1.5% + APPLICABLE TAXES

Team Member

Events At Semona Micro Finance

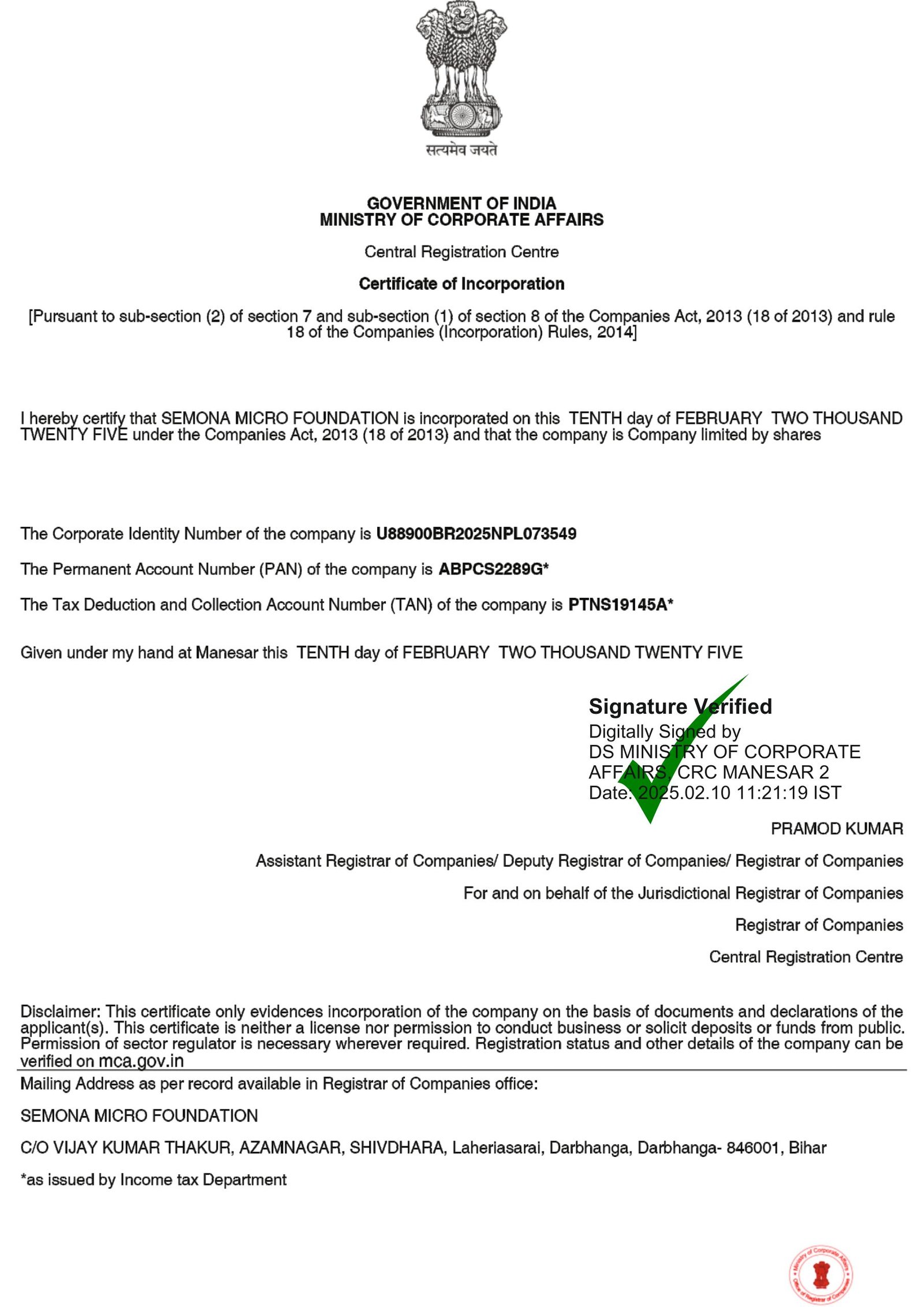

LEGAL CERTIFICATE